The Massachusetts Community

Investment Tax Credit

Wellspring Cooperative is a Massachusetts Community Development Corporation (CDC) that works to create an economy that is cooperative, equitable, democratic, and sustainable. We work with historically under-served communities in the Greater Springfield region by developing a network of worker cooperatives and by supporting community-led initiatives to cultivate cooperatives and collective well-being.

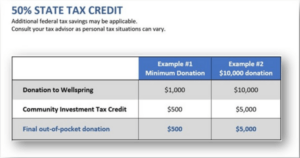

Anyone giving a donation of $1,000 or more is eligible to receive half of that donation back in the form of a tax credit if you owe state taxes or cash if you don’t owe state taxes. This applies to out-of-state folks as well. It is called the Community Investment Tax Credit Program or CITC Program. The program was created to leverage the tax credit to encourage donors to double their donations to vetted organizations like Wellspring. See what people are saying about the program.

Massachusetts AND out-of-state donors of $1,000 or more are eligible for this Massachusetts tax credit. Donors can be:

- Individuals

- Foundations

- Corporations

- Donor Advised Funds (Tax credit or refund goes to DAF and not to you personally. Check with your DAF financial institution to see if they participate.)

Note: Only cash donations are eligible. Stock gifts are not eligible.

Credits are limited. For availability contact Development Coordinator Kristan Bakker for credit availability.

THANK YOU!

* FOOTNOTE *

Massachusetts CDCs are organizations vetted by the State that develop and improve

urban, rural, and suburban communities in sustainable ways that create and expand

economic opportunities for low- and moderate-income people