Wellspring Cooperative is a Massachusetts Community Development Corporation (CDC)[1] that works to bring urgently needed economic transformation to low income and unemployed residents of the city of Springfield by the creation of worker-owned businesses called co-ops...creating jobs and wealth opportunities where it’s needed most in the neighborhoods of the city.

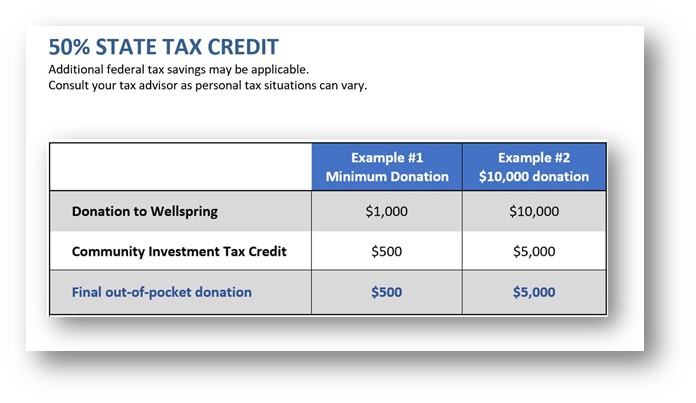

A benefit of being a member of the Massachusetts Association of CDCs is that donors who make cash donations of at least $1,000 can receive a Massachusetts tax credit for 50% of that donation. It is called the Community Investment Tax Credit Program or CITC Program. The program was created to leverage the tax credit to encourage donors to double their donation to vetted organizations like Wellspring. NOTE: Tax credits are limited. Check for availability by contacting Development Coordinator, Kristan Bakker.

Who is eligible to receive the Community Investment Tax Credit? Massachusetts AND out-of-state donors of $1,000 or more are eligible for this Massachusetts tax credit. Donors can be:

Note: Only cash donations are eligible. Stock gifts are not eligible

HELP Wellspring increase our impact in 2023 by making an eligible contribution.

For more information and credit availability,

contact Development Coordinator Kristan Bakker

[1]Massachusetts CDCs are organizations vetted by the State that develop and improve urban, rural, and suburban communities in sustainable ways that create and expand economic opportunities for low- and moderate-income people